Excitement About Transaction Advisory Services

Table of ContentsThe smart Trick of Transaction Advisory Services That Nobody is Discussing6 Simple Techniques For Transaction Advisory ServicesThe Of Transaction Advisory ServicesUnknown Facts About Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory Services

This action ensures business looks its best to potential buyers. Obtaining the service's value right is crucial for an effective sale. Advisors make use of various techniques, like discounted cash circulation (DCF) analysis, comparing to similar business, and recent transactions, to find out the fair market worth. This helps establish a fair rate and work out properly with future purchasers.Deal advisors action in to assist by obtaining all the required information arranged, responding to concerns from purchasers, and setting up brows through to the organization's area. Purchase experts utilize their competence to assist service proprietors take care of challenging arrangements, fulfill customer assumptions, and structure deals that match the proprietor's goals.

Meeting lawful policies is critical in any kind of service sale. Deal advisory solutions function with legal professionals to create and evaluate contracts, arrangements, and other legal documents. This decreases risks and makes certain the sale adheres to the legislation. The role of transaction experts prolongs beyond the sale. They aid service owners in preparing for their following steps, whether it's retired life, beginning a new endeavor, or managing their newly found riches.

Transaction advisors bring a wide range of experience and knowledge, making sure that every aspect of the sale is managed expertly. Via tactical prep work, valuation, and settlement, TAS aids business owners attain the highest possible price. By ensuring legal and regulative conformity and managing due diligence together with various other bargain team participants, deal experts minimize prospective dangers and responsibilities.

Getting The Transaction Advisory Services To Work

By comparison, Huge 4 TS groups: Deal with (e.g., when a possible customer is carrying out due persistance, or when an offer is closing and the customer needs to incorporate the company and re-value the seller's Equilibrium Sheet). Are with fees that are not connected to the offer shutting effectively. Gain costs per interaction somewhere in the, which is much less than what financial investment financial institutions make even on "small bargains" (however the collection chance is additionally much greater).

The meeting inquiries are really comparable to financial investment banking meeting questions, but they'll concentrate extra on accounting and valuation and much less on topics like LBO modeling. As an example, anticipate inquiries regarding what the Modification in Capital ways, EBIT vs. EBITDA vs. Internet Income, and "accountant just" topics like trial equilibriums and exactly how to go through events making use of debits and credit ratings instead than economic statement changes.

The Basic Principles Of Transaction Advisory Services

Professionals in the TS/ FDD teams may also interview administration about every little thing above, and they'll compose a detailed report with their findings at the end of the process.

, and the basic shape looks like this: The entry-level role, where you do a lot of information and economic analysis (2 years for a promotion from below). The following level up; similar job, however you get the more intriguing bits (3 years for a promo).

In certain, it's difficult to obtain promoted past the Manager level due to the fact that few people leave the work at that stage, and you require to start showing proof of your capability to generate earnings to advancement. Let's begin with the hours and way of life because those are much easier to describe:. There are periodic late nights and weekend break job, however absolutely nothing like the frenzied nature of investment financial.

There are cost-of-living adjustments, so expect lower payment if you're in a more affordable area outside significant financial (Transaction Advisory Services). For all positions except Partner, the base pay makes up the bulk of the total payment; the year-end incentive could be a max of 30% of your base salary. Frequently, the finest method to enhance your incomes is to Our site change to a various firm and work out for a higher salary and perk

The Only Guide to Transaction Advisory Services

You could obtain into corporate growth, however investment financial gets extra tough at this stage because you'll be over-qualified for Expert functions. Corporate money is still a choice. At this phase, you ought to simply stay and make a run for a Partner-level function. If you wish to leave, possibly transfer to a client and do their appraisals and due diligence in-house.

The primary trouble is that since: You generally need to join an additional Big 4 team, such as audit, and work there for a few years and afterwards move right into TS, job there for a few years and afterwards relocate into IB. And there's still no guarantee of winning this IB duty because it relies on your area, clients, and the working with market at the time.

Longer-term, there is also some risk of and because examining a firm's historical financial information is click over here now not precisely brain surgery. Yes, people will certainly constantly need to be involved, however with even more advanced innovation, lower headcounts might moved here potentially sustain customer involvements. That claimed, the Purchase Providers team defeats audit in regards to pay, job, and exit opportunities.

If you liked this short article, you may be interested in reading.

Getting My Transaction Advisory Services To Work

Create advanced economic structures that aid in figuring out the real market worth of a firm. Offer advisory operate in connection to service assessment to help in negotiating and pricing structures. Describe one of the most suitable type of the bargain and the sort of consideration to utilize (money, supply, gain out, and others).

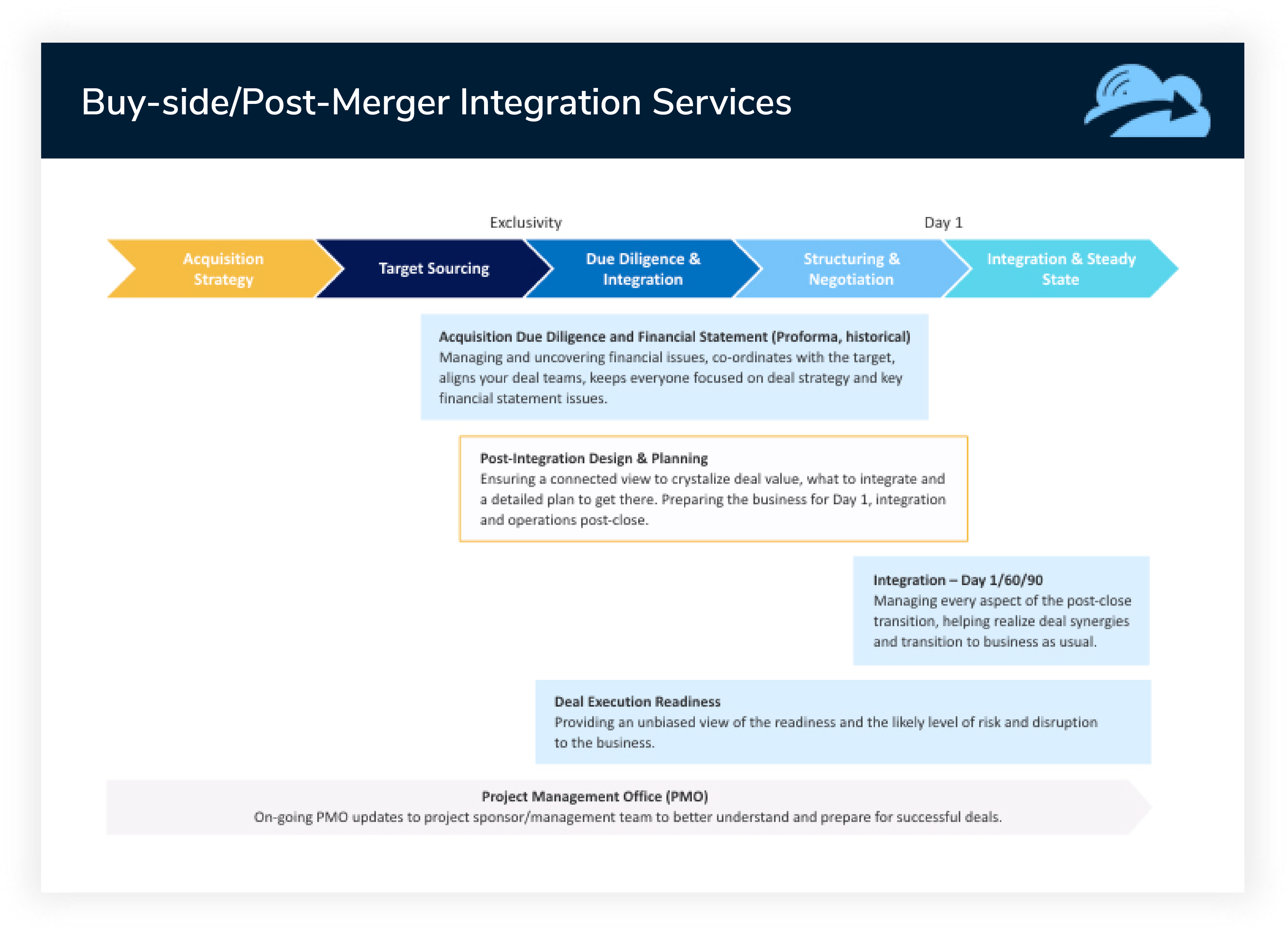

Carry out integration planning to determine the process, system, and organizational changes that might be called for after the bargain. Establish guidelines for integrating divisions, innovations, and business procedures.

Analyze the prospective client base, industry verticals, and sales cycle. The operational due diligence supplies essential understandings right into the performance of the firm to be acquired worrying risk analysis and value development.